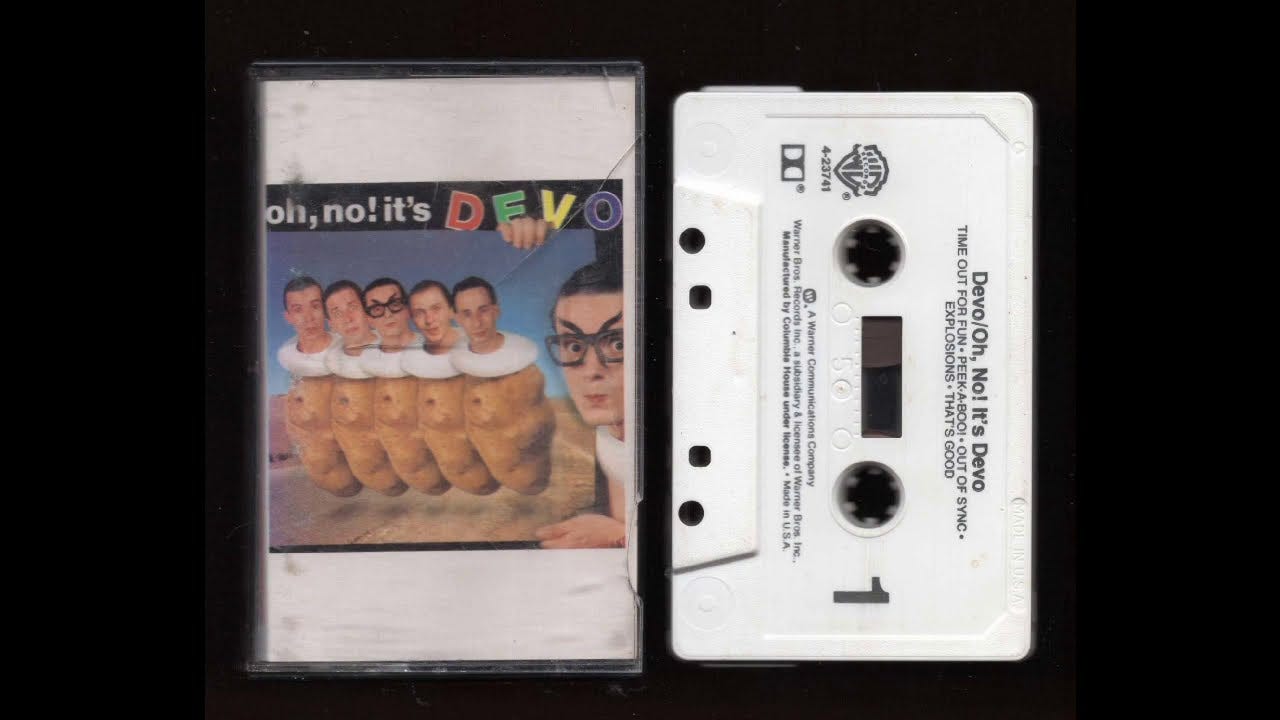

Anyone who was into early ‘80s indie music may be familiar with Whip It, the biggest UK hit (reaching a giddy #51 in the charts!) for Devo, an American new wave band from Ohio.

Devo has been described as a band that “mingles kitsch science fiction themes, deadpan surrealist humor and mordantly satirical social commentary.” I can’t think of a better soundtrack for the English Devo(lution) White Paper.

Yes, just when you think things are winding down for Christmas, the Government goes and publishes proposals for yet another reorganisation of local government.

Having worked for 72 councils across the UK over the past three decades, I’ve seen the good, the bad and the ugly of local government first hand. In almost every place, I’ve found committed and well-meaning people trying to encourage growth and attract new jobs and investment. But the overwhelming cloud of impending reorganisation has always hung over almost every town and city.

Every few years the jigsaw pieces of economic development are thrown up in the air as teams are restructured; borders redrawn; budgets merged; nameplates changed; and new lexicons introduced. With every shakeup, there seems to be a few less pieces remaining though. Some pieces are torn and frayed. And the box lid that shows us what to do, is long gone.

The infuriating thing is that the basics of inward investment don’t change:

Companies want and need locations.

Locations want and need investment.

That was the case in 1925. And in 2025. And will be the case in 2125.

It doesn’t matter who is prime minister; or which party is in power; or what the structure of local government is in any given decade… your town, city, region and country needs to be putting its best feet forward and spending every minute it can engaging with businesses; encouraging and facilitating growth. So every minute that local teams waste navel-gazing and worrying what they’ll be called next year; another team is, as the Americans say, ‘eating your lunch’.

In the foreword to the white paper, Deputy Prime Minister Angela Rayner says:

“The Westminster system is part of the problem. Whitehall is full of layers of governance and bureaucracy, controlled and micromanaged from the centre. To truly get growth in every corner of the country and put more money into people’s pockets, we must rewire England and end the hoarding in Whitehall by devolving power and money from central government to those with skin in the game.”

I agree 100%. It’s the kind of analysis that you’ll hear from Javier Milei in Buenos Aires to Elon Musk in DC as a prelude to taking a chainsaw to government bureaucracy.

But forgive me for doubting whether this attack on hyper-centralised command and control governance is going to be the magic wand that drives the economic growth that everyone craves.

A paradox runs throughout the White Paper that worries me…

We want local areas to take back control. But do as we say. Or else.

If you don’t play nice, we’ll do it anyway.

Choose your own future, oh but you must build thousands of new homes.

In fact these are just the kind of surreal lyrics Devo would sing.

From LEPs and CAs and MCAs, to SAs, MSAs, FSAs and EMSAs. A new glossary of acronyms to learn. It’s almost as if the magicians in Whitehall are unveiling new shiny balls to distract us all and perpetuate an illusion of progress.

I will leave to others the task of interpreting the nuances and details of local governance, and I’ll stick to what I know - inward investment.

None of these changes will have any likely impact on inward investment in the short-term. The Paper mentions the Office for Investment a few times, and their increased role is welcomed - especially if it advances the creation of a standalone investment promotion agency that the country has lacked since it was subsumed into a government department.

The six ‘Integrated Settlement’ areas - Greater Manchester; West Midlands; West Yorkshire; South Yorkshire; North East and Liverpool City Region - will get Office for Investment support to further develop and market propositions.

“The Office for Investment will work with Mayors to develop and market strategic investment propositions.”

“The Office for Investment will work with Established Mayoral Strategic Authorities to develop and jointly market investible propositions for significant, commercially viable opportunities, in order to land key strategic investments.This offer will be prioritised for Established Mayoral Strategic Authorities initially and extended out to other Mayoral Strategic Authorities where possible. The Office for Investment will also explore establishing a senior official-level forum with Mayoral Strategic Authorities on a pan-regional basis.”

While this collaboration between the most devolved authorities in the six big city-regions is welcomed, I’m a little concerned that other parts of the country might get left behind.

Some of the UK’s best strategic inward investment successes of recent years have been in more rural counties - such as Somerset, Kent, Warwickshire and Cheshire. Some of the most competitive offers are in places like Reading; Milton Keynes; and Telford. In fact, the whole of England, from Cornwall to Cumbria makes up a fantastic inward investment proposition with dozens of cities like Oxford; Cambridge; Brighton; Nottingham; Leicester; Derby and many more, which are unlikely to be in the vanguard of local government reorganisation.

Irrespective of the shape and timing of new strategic authority areas, we cannot afford to lose any more time in the daily battle for inward investment. It took the incoming government 120 days to find an inward investment minister, and for all the talk of Invest 2035, the new industrial strategy, this won’t see the light of day for a few more months because of consultations. The only speedy actions impacting inward investment have so far been negative - in the form of tax rises. The last thing we need now is for local investment teams to get caught up in devo shenanigans.

The Office for Investment should focus on the parts of England listed above that don’t have the advantages of their big city mayoral colleagues.

Another area of concern is the continuing desire by Westminster and Whitehall over the last few years, to try to segment the country into neat sectoral silos. The obsession with clusters is really dated.

“We see burgeoning clusters like:

- Life sciences in places like Cambridgeshire & Peterborough and Liverpool City Region

- Financial services in places like West Yorkshire and London

- Advanced Manufacturing in places like Greater Manchester, West Midlands, North East, and South Yorkshire

- Clean energy and green industries in places like the North East, the East Midlands, the West Midlands, Tees Valley, York and North Yorkshire, and around the Humber

- Digital industries in the West of England.”

I’m sorry that’s not how business works. And having a cluster is no guarantee of inward investment success anyway. Just look at the JLR gigafactory choosing Somerset.

Name-checking your favourite areas and lining them up against an ill-defined umbrella cluster serves no practical purpose.

What we have is a fantastic, multifaceted proposition for ‘England’ - a place which in the global context is about a third the size of Texas. And a place which has an oven-ready brand that is internationally recognised. And yet still, we’re afraid to use it.

Most international investors have no clue where or what the North East; East Midlands or South Yorkshire are. To most of the world looking at a map, the West of England would be Wales; the North East would include Aberdeen; and London covers most of the country.

Maybe the next few years of restructuring presents the opportunity to create world-beating propositions for England that can land the investments we so badly need.

In the words of Devo…

Now whip it

Into shape

Shape it up

Get straight

Go forward

Move ahead

Try to detect it

It's not too late

To whip it

Whip it good

Happy Christmas!

I look forward to sharing thoughts around foreign investment in 2025!